For years, we’ve been told that the reason women entrepreneurs receive less funding is because there are fewer of them. But the data says otherwise – and it’s getting harder and harder to ignore. Until we stop treating women-led ventures as niche bets and start seeing them as the smart, scalable investments they are, we’ll keep leaving impact – and revenue – on the table.

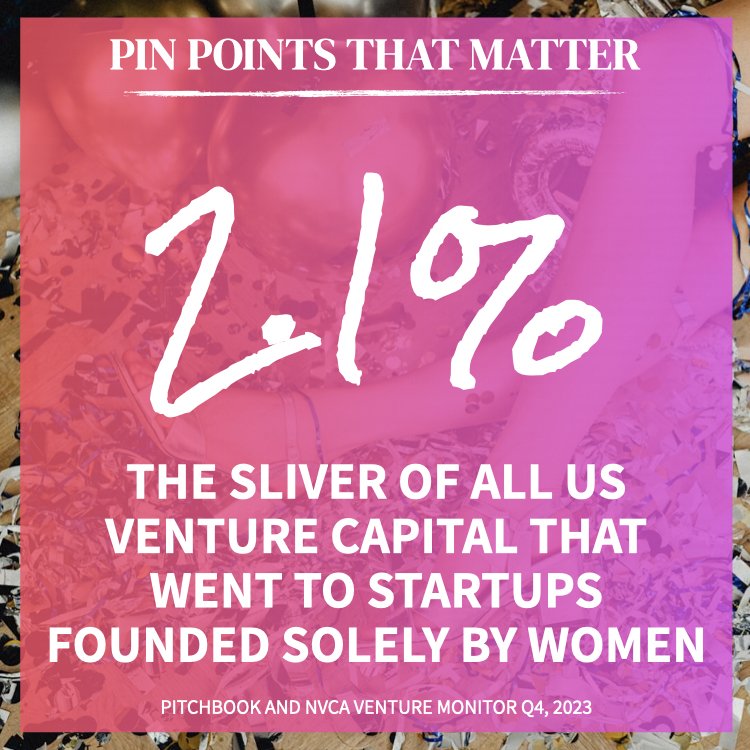

2.1% – That’s the sliver of all U.S. venture capital that went to startups founded solely by women in 2023. – PitchBook and NVCA Venture Monitor Q4 2023 via TechCrunch

And just 1.4% – That’s how much of VC funding went to companies with a woman CEO that same year. – Women in VC Report, 2023, cited in Fortune

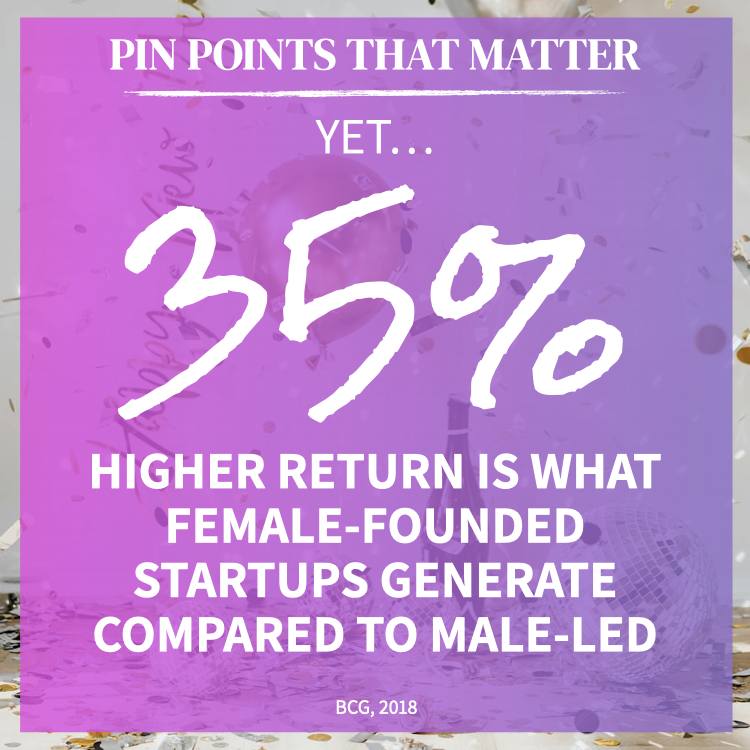

Yet, 35% – That’s the higher return female-founded startups generate, on average, compared to their male-led counterparts. – Boston Consulting Group (BCG) & MassChallenge, “Why Women-Owned Startups Are a Better Bet,” 2018

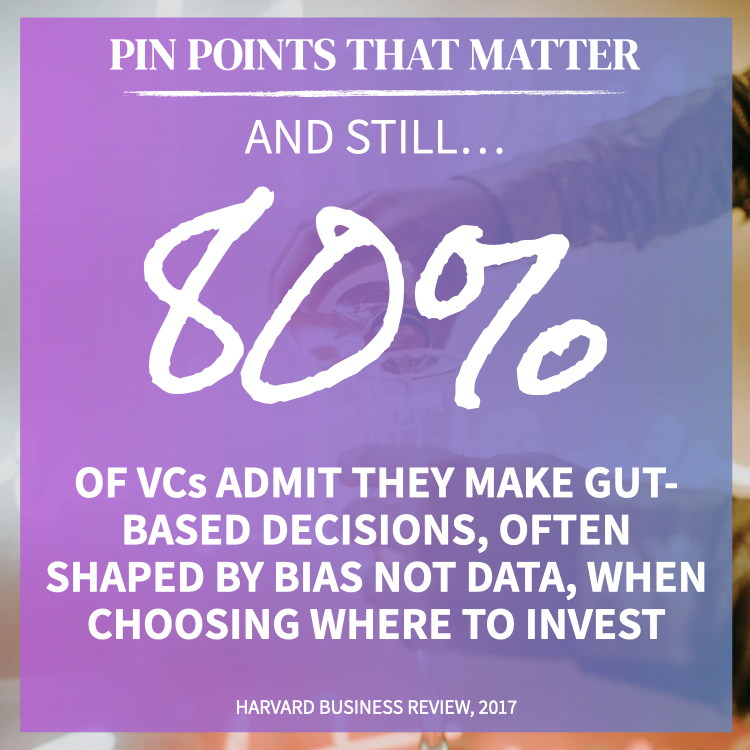

And still, 80% – That’s how many VCs admit they make gut-based decisions when choosing where to invest—gut instincts shaped by bias, not data. – Harvard Business Review, “We Recorded VCs’ Conversations and Analyzed How Differently They Talk About Female Entrepreneurs.

The data is loud. It’s time the decisions caught up. If you’re in a position to fund, amplify, or back great ideas—start with the ones that have always been underestimated. And if you need ideas or inspirations, hit us up.

Change starts with awareness—but it can’t stop there.